Wire transfers can be sent either through a local bank branch or an online banking form. Although, in theory, you can cancel a wire transfer, that cancellation is only before it’s processed. Be extra careful to double-check your information. Once the money is sent through a wire transfer, getting the funds back may not be possible if the wire is sent to the wrong recipient or bank account. The payer’s bank is called the sending bank or originating bank. The recipient’s bank is called the receiving bank. The wire transfer recipient may need to complete incoming wire transfer instructions through a form from the recipient’s bank. The IBAN includes the BIC bank routing number. International banks use BIC (bank identification code) as an identifier.

#Wire transfer fee code#

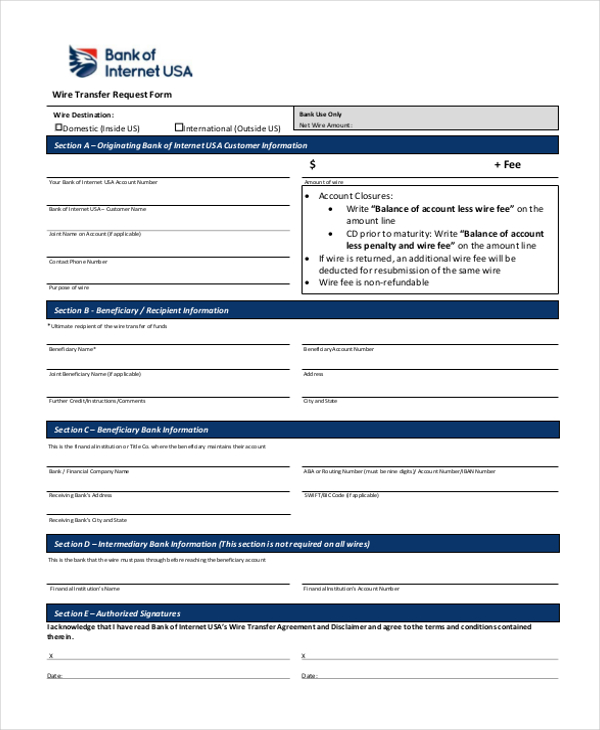

An alphanumeric standard format IBAN (international bank account number) is used for internationally sent wire transfers, indicating the country code and other identifying routing number information. In the U.S., routing numbers for an outgoing domestic wire transfer transaction are ABAįor domestic transfers and SWIFT code for international transfers. The date of the wire transfer remittance.The amount of money for the wire transfer being sent.The bank routing numbers, bank accounts, and bank name and address for the sender and recipient.The names and account information, including contact information, of the sender and recipient.To send a wire transfer, you need to complete outgoing wire transfer instructions, which includes: The FinTalk Blog Strategy and trends in payments.Customer Stories See how we transform finance operations.Why Tipalti A modern, holistic, powerful payables solution that scales with your changing business needs.The Tipalti Platform Global, scalable, and fully automated.Expenses Mobile ready integrated expenses and global reimbursements.Global Partner Payments Scalable mass payout solutions for the gig, ad tech, sharing, and marketplace economies.Procurement Complete control and visibility over corporate spend.Accounts Payable Automation End-to-end, global payables solution designed for growing companies.Rather than cash, the participating institutions share information about the recipient, the bank receiving account number, and the amount transferred. A transfer is usually initiated from one bank or financial institution to another. They allow two parties to transfer funds even if they're in different (geographic) locations safely.

Wire transfers, which are also known as wire payments, allow money to be moved quickly and securely without the need to exchange cash. All transfers go through a domestic automated clearing house before they are settled.International wire payments are monitored by the Office of Foreign Assets Control to ensure the money isn't being wired to terrorist groups or for money laundering purposes.Most wire transfers can take as long as two business days to process.Senders pay for the transaction at the remitting bank and provide the recipient's name, bank account number, and the amount transferred.A wire transfer facilitates money transfers electronically across a network of banks or transfer agencies around the world.

0 kommentar(er)

0 kommentar(er)